10 Effective Ways to Reduce Chargebacks in 2022 (FAST)

Do you want to discover the most effective ways to reduce chargebacks? Continue reading to learn more!

Enabling digital payments is indisputably one of the best ways to increase your sales and expand internationally without excessive investment. However, because online processing is associated with CNP (Card Not Present) transactions, there is a higher risk that cardholders file a complaint against the merchant in suspicion of fraudulent movements.

For this reason, merchants need to work proactively towards taking the necessary measures to reduce chargebacks.

What is a chargeback?

A chargeback, also called a payment dispute, is a form of customer protection that allows cardholders to file a dispute against the merchant regarding fraudulent transactions on their statement.

If the customer chooses to request a chargeback, the issuing bank is in charge of investigating the case and determining its legitimacy.

As a merchant, if a dispute has been filed against you, it will be in your hands to prove that the transaction was legitimate.

If the issuing bank decides that it was a fraudulent transaction, the entire value of the purchase will be taken from your account, along with an additional fee that can reach up to $100 depending on the bank.

Why is it important to reduce chargebacks?

Chargebacks were created to protect the customers from fraudulent transactions. However, in order to understand how important it is for a company to reduce chargebacks, we need to think about the reasons why they are filed in the first place.

In some cases, the person didn’t recognize a transaction and requested a chargeback because it could have been fraudulent. But this is not always the case.

On many occasions, the transaction was real but the customers filed a chargeback anyway because there was an issue, the company didn’t look trustworthy, or they couldn’t get in touch with the team.

Sometimes, the customer wanted to request a refund for their purchase but they couldn’t do it, and they decided to file a chargeback instead.

Here are some of the most common reasons why cardholders file a payment dispute:

• They don’t recognize the transaction on their bank statement;

• The purchase seems to have been charged twice (duplicate transaction);

• They were charged despite cancelling their subscription;

• They didn’t receive the product or it didn’t look like the one in the description;

• The customers didn’t recognize the company behind the transaction.

In order to reduce chargebacks and improve your overall conversion rate, it is extremely important to understand the reasons behind it, and what can happen if your chargeback frequency is high.

What are the consequences of a high chargeback rate?

All companies will have to face payment disputes every once in a while. That’s completely normal and there is no way to prevent it fully from happening.

However, every organisation should aim to reduce chargebacks not only because of revenue health, but also because of possible penalties.

Merchants with a high chargeback rate face multiple consequences, including monetary penalties by acquirers as well as card association fines of up to $100 or more per chargeback. The industry standard is to keep a chargeback ratio below 0.9%.

For this reason, although it may seem counterproductive, one of the most effective ways to reduce chargebacks is to allow purchase refunds. Let’s dive right into all of them:

10 effective ways to reduce chargebacks

Fortunately, even if it's impossible to completely eliminate disputes initiated by customers, there are measures that every merchant can proactively take to reduce chargebacks and improve the overall performance of his business:

1. Make your contact information easily accessible

While some customers might issue a chargeback immediately after detecting an inconsistency in their credit card statement, it is not the usual case.

Usually, they will try to work out potential issues with the merchant before filing a dispute. To avoid chargebacks issued out of frustration because your customers weren't able to locate you, make sure that your contact information is available and easily accessible on your website.

How to reduce chargebacks: make sure that your contact information is visible and easy to access

Provide as many contact channels as possible, including but not limited to:

• Your company email address;

• Your phone number;

• All social media channels;

• Your physical address;

• A live chat or Whatsapp number for faster communication;

Having multiple contact channels that are easily accessible for your customers will not only make your brand more authentic and trustworthy, but will also facilitate their communication with you to sort out any possible issues.

This will not only give you the opportunity to find a win-win solution with your clients, but will also show that you are a merchant in which they can trust over the long run.

2. Offer refunds if the customer is not satisfied with your product

One of the best ways to reduce chargebacks is to have a clear refund policy and make it easy for customers to get their money back if they are not satisfied with the product.

Having a money-back-guarantee policy will not only help you get less chargebacks, but will also encourage more people to try out your product. According to Social Triggers, it may boost your conversion rate from 21% to 300% on top of preventing possible payment disputes.

Reduce chargebacks by offering refunds. Example: optinmonster.com

Some companies don't offer refunds because they are scared about losing revenue, but this is a short-term solution. Your long-term goal should be to keep your customers happy and avoid disputes at all costs, especially after considering the above-mentioned penalties for high chargeback frequency.

If a person is not satisfied with your products, he will find a way to get his money back, and requesting a chargeback might not be the best option as it may hurt your business.

3. PCI Compliance is a must if you want to reduce chargebacks

Another effective way to reduce chargebacks is by becoming compliant with the official standard for credit card data protection PCI-DSS.

If you process payment transactions on your website, you will need to take solid security measures to make sure that you are handling cardholder data correctly.

Because chargebacks are usually associated with credit card fraud and unauthorized transactions, PCI provides anti-fraud measures for checking the validity of the card, and whether it has been associated with suspicious transactions in the past.

The fastest way to achieve PCI Compliance is to accept payments with a Payment Gateway that is already compliant with PCI-DSS, such as MYMOID.

4. Send confirmation emails to your customers

As a merchant, one way in which you can reduce chargebacks is to make sure that the customer always receives a confirmation email with an invoice right after the purchase.

This action is a must because it will confirm that his payment has been processed correctly, reducing possible frustration and giving him enough time to react in the case of an actual fraudulent action.

Effective ways to reduce chargebacks: send confirmation emails

This will allow him to contact you and work out the problem with you before issuing a chargeback. Once the product has been shipped, it is recommended to send another confirmation email providing the shipping details and the tracking information.

5. Provide a clear transcription description

A lot of customers issue a chargeback because they are unable to recognize the charge on their credit card statement.

To resolve this issue, a recognizable descriptor that matches your website name and branding should be reflected on the bill.

If your descriptor uses the legal name of your company instead of the name that appears on the website, customers can get confused and file a dispute because they do not recognize the charge.

These details may seem unimportant, but they actually are essential**.** To effectively reduce chargebacks, companies need to ensure that they are doing everything in their hands to establish a trustworthy brand.

If customers feel secure and trust the brand before making their purchase, they would be less likely to file a payment dispute if something occurs. And of course, we have the extremely important benefit of increasing conversion rates as a result of your trustworthiness.

6. Provide excellent customer service

Providing outstanding customer service and being an honest seller should always be your top priority if you want to reduce chargebacks and keep your customers long-term.

If you prove yourself as a transparent and trustworthy provider, your clients will be encouraged to work out the issue directly with you instead of requesting a chargeback.

Having great customer service is just as important as having a great product. If you are not there for your customers when they need you, they might not only switch to a competitor but also file a payment dispute.

Depending on your resources, make sure that you:

• Have multiple communication channels so that customers can contact you in the way that’s the most comfortable for them.

• Aim to deliver responses as fast as possible - whether it means a 24/7 customer support service or answering in 1 working day.

• Provide additional knowledge resources - especially if you are in the SaaS industry, providing resources such as blog posts, knowledge base articles and tutorials is a great way to reduce customer support volume requests.

7. Contact customers with suspicious orders

If you notice suspicious movements, such as bulk orders, multiple orders in a short period of time, or mismatch between the billing and delivery address, contact the customer to make sure that the order is legit.

By doing so, you will continue building their trust, and both of you will be able to detect a possible fraudulent transaction before it escalates. You can also verify the address of the customer by calling the Voice Authorization Center of the issuing bank.

Additionally, aside from verifying the security code and billing address, request the name of the issuing bank as a part of your purchasing policy - failure to do so is definitely a red flag.

8. Collect signatures upon delivery

To reduce chargebacks, always make sure that your carriers collect the signature of the receiver upon delivery. As a merchant, you need to keep a copy of the signed document.

As we mentioned earlier in the article, many chargebacks are filed because the customer claims that he hasn’t received the product. While this is something that can happen to everyone, sometimes there could be fraudulent claims by the customer as well, which can affect the merchant negatively.

In this case, collecting signatures upon delivery is one way in which you can reduce chargebacks for possible false claims.

9\. Your subscriptions should be opt-in

If you provide subscription-based or recurring billing services, and you offer a free trial to your potential customers, always give the option to opt out of the paid service.

A lot of companies have the policy to upgrade a customer automatically to the paid plan after the free trial is over. While this is a very common practice, especially in the SaaS industry, many customers can find it frustrating and even abusive.

If they are not able to ask for a refund or money back, they will most probably file a payment dispute because they didn’t want to sign up for the paid service after the free trial.

Automatically upgrading them to the paid plan after the free trial not only provides a poor customer experience, but also encourages them to file chargebacks.

10. Using a Payment Gateway reduces chargebacks significantly

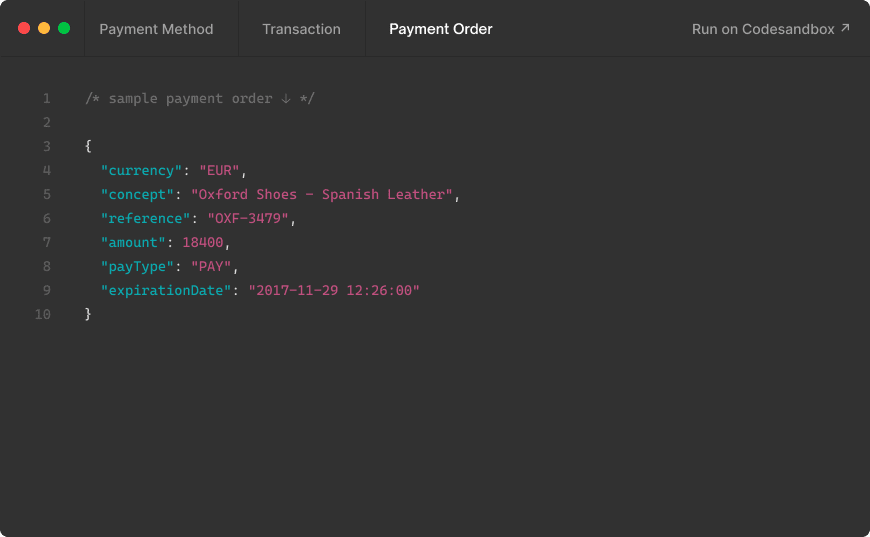

One of the most effective ways to reduce chargebacks and avoid getting penalties from acquirers and card issuers is to use a PCI-compliant Payment Gateway such as MYMOID.

A gateway that is in full compliance with PCI-DSS, the Payment Card Industry Data Security Standard, not only facilitates transactions by encrypting and securely transferring cardholder data, but also gives the merchant full control over their payment logic.

By having control over the entire purchase process, merchants can react immediately if something occurs, which results in reduced chargeback volume and operations risk.

At MYMOID, we know that chargebacks can be difficult to prevent and handle, that's why we are here to help. If you have questions or want to learn more on how to avoid disputes, do not hesitate to contact us. Our team will be happy to work with you to reduce payment disputes and scale your business with the right payments partner.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

6 Types of Payment Fraud & How to Mitigate Them Effectivel

Know about the most common types of payment fraud, and what are some of the measures that your company can take in order to protect itself and your customers from fraudulent transactions.

2022-01-20

Órdenes de pago online y pago por link: El MUST de las pasarela de pagos.

¿Dificultades para gestionar los cobros? Crea ordenes de pago online y envía por link.

2024-10-22

PCI-DSS for E-Commerce: 6 Key Things You Need to Know

PCI-DSS - Payment Card Industry Data Security Standard, an essential protocol that should be followed by all companies that handle payment transactions.

2022-01-09

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy