What Are Friendly Fraud Chargebacks? +9 Top Ways to Fight Them

let's take a look at what a chargeback exactly is

Chargebacks are among the biggest nemesis of every business. More often than not, they cause lost revenue, damage on the company's reputation, and waste of time handling the chargeback. According to Forbes, they can cost up to three times the transaction amount! In this article, we will discuss friendly fraud chargebacks, what you need to know about them, and how you can protect yourself as a merchant.

But before we dive into friendly fraud chargebacks, let's take a look at what a chargeback exactly is:

1. What is a chargeback?

A chargeback is a essentially a payment dispute between the customer and the merchant in which the customer files a complaint with the issuing bank, requesting the reversal of funds.

Chargebacks were originally created to protect customers from fraud, but some types of chargebacks can be considered fraud as well - as in the case of Friendly Fraud, which we are going to discuss today.

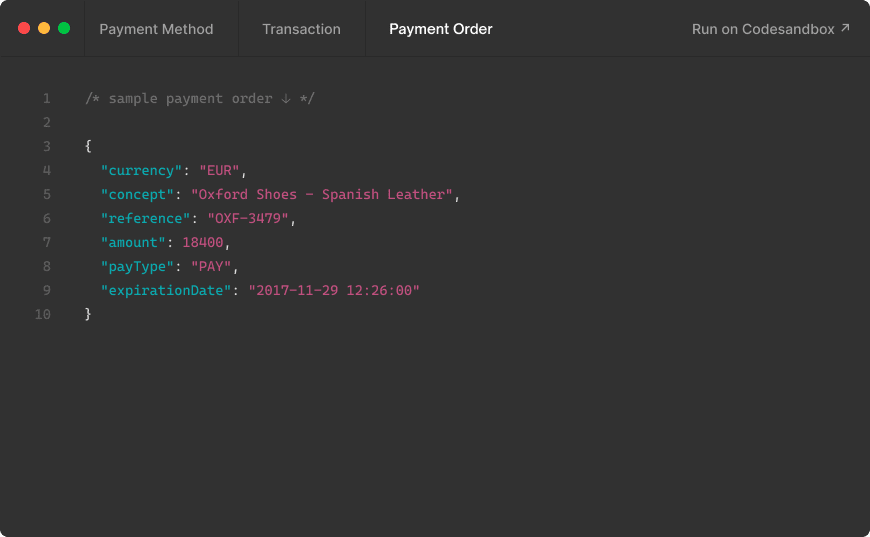

The chargeback process. Source: visa.com

Chargebacks were introduced as a way to protect customers against fraudulent charges or purchases, but also to give customers the opportunity to resolve a serious issue that couldn't be resolved directly with the merchant. Which is also what makes them different from refunds, which is the reversal of funds issued directly by the merchant.

Legitimate customers often file a chargeback for these reasons:

• They don't recognize a charge on their credit card, and suspect it was fraudulent.

• The package was never delivered to the customer.

• The package came damaged or defective, and the merchant didn't provide a reasonable solution.

• There were incorrect charges, as the amount charged didn't coincide with the amount of the purchase.

2. What are the different types of payment fraud?

As we discussed in our previous article, there are different types of payment fraud that both customers and merchants should be aware of. You can click on the article above to read more about them, but here is a quick summary because we dive into friendly fraud chargebacks:

• Phishing attacks - include email phishing, spear phishing, whaling and more - techniques that fraudsters use to collect payment data through deceptive communication, usually done via email or SMS.

• Triangulation - in which the fraudster, acting as a third-party marketplace seller, executes the actual order by making the purchase on a genuine retailer and paying with stolen credit card information before shipping the product to the customer.

• Wire transfer scams - in this type of fraud, the criminal disguises himself as a trusted source (for example, a legitimate company or a family member), and requests an urgent wire transfer of funds to their account.

• Merchant identity fraud - this fraud happens when the scammer sets up a merchant account acting as if they were the legitimate business, and then charging stolen debit or credit cards.

• Friendly fraud - and of course, we have friendly fraud chargebacks - in which the legitimate customer makes a purchase, but then files a chargeback claiming that they never purchased the item, or it wasn't delivered.

And now, let's zoom in one friendly fraud chargebacks, what are they exactly, and what merchants can do to prevent them and protect themselves:

3. What is a friendly fraud chargeback?

Put simply, a friendly fraud chargeback is a type of chargeback that occurs when a customer makes a legitimate purchase, but then files a dispute with the issuing bank claiming that they didn't receive the item or they never made the purchase at all.

Of course, when talking about friendly fraud chargebacks, it is important to keep in mind that we are talking about those cases in which the customer had actual fraudulent intentions despite having received the product in perfect condition.

This is different from legitimate disputes - cases in which the customer truly never made the purchase or received the product. Although sometimes, it's difficult to differentiate between both in a real-life situation.

Friendly fraud chargebacks. Source: chargebacks911.com

Unfortunately, friendly fraud chargebacks have been on the rise over the last few years, and especially during the global pandemic. According to Chargebacks911, more than 66% of customers in 2020 committed friendly fraud by claiming that their products never arrived, or were in bad condition.

4. Are friendly fraud chargebacks always fraudulent on purpose?

It's also important to understand that some consumers can commit friendly fraud unintentionally. They may not have a good understanding of how the chargeback process works, and end up disputing directly with the issuing bank without realizing the consequences of their actions on the merchant.

A common case of friendly fraud chargebacks happens within a single family. For example, a child taking the credit card of their mother or father and making a purchase (let's say, on a game) without letting them know about it.

When the parent sees the charge and doesn't recognize it, they may end up filing a chargeback to resolve the issue with the bank. Here are some other occasions in which a customer may file an accidental chargeback without malicious intentions:

4.1. They don't recognize the billing descriptor of the merchant

As we explained in our article 10 Effective Ways to Reduce Chargebacks in 2022 (FAST), a customer can make a legitimate purchase, but then get confused upon the revision of the credit card charges, and file a chargeback as a result.

This is especially common if the merchant hasn't provided a clear billing descriptor. For example, if the descriptor uses the legal name of the company instead of the name that's familiar to the customer (the on the merchant's website, social media, etc.), this may cause a confusion which can end up in a chargeback.

4.2. The customer forgot about a recurring payment

Subscription-based businesses have been on the rise in the last few years - think about Netflix, Spotify, Disney Plus and more. In fact, [according to Entrepreneur](https://www.entrepreneur.com/article/383013#:~:text=Gartner forecasts that SaaS platforms,in the shattered business world.), SaaS platforms were estimated to generate close to $117.7 billion by the end of 2021.

However, many people sign up for a lot of subscription-based services without keeping track of them. Friendly fraud chargebacks may also occur if a person has forgotten about their recurring payment - especially if subscriptions are renewed with less frequency, such as once per year.

As a result, the customer may get scared that they have been wrongly charged or there has been a fraudulent purchase with their credit card, and file a payment dispute with the issuing bank.

4.3. The customer wasn't satisfied with the merchant

Friendly fraud chargebacks may also happen when customers are losing patience with the merchant. For example, if they requested a refund and it's taking longer than expected, they may decide to go to the issuing bank instead so the issue can be resolved as fast as possible - without realizing or thinking about the consequences that this may have for the merchant.

It can also happen if it's difficult to get in touch with the merchant, their customer support is lacking or doesn't resolve anything. In other words, a customer may resort to this option if they encounter any obstacles regarding their purchase.

4.4. The customer doesn't understand the differences between chargebacks and refunds

As we mentioned previously, chargebacks and refunds are both reversal of funds, but they have one main difference: and that is, who executes it. Refunds are typically requested to the merchant, and he is the one who approves them or rejects them, releasing the funds to the cardholder if approved.

A chargeback, however, is a payment dispute initiated directly with the issuing bank instead of the merchant.

5. What are the consequences of friendly fraud chargebacks?

Whether intentional or accidental, there is no doubt that merchants will suffer negative consequences as a result of friendly fraud chargebacks. Apart from losing the revenue from the original transaction, they may also have to pay additional chargeback fees, as well as lose time and money fighting invalid charges, and proving the legitimacy of the transaction.

In addition, all costs associated with shipping, handling, customer service, and even payment processing fees will go to waste, adding up to the total loss. Studies have shown that the average merchant loses $3.60 in revenue for every $1 in original transactional value.

If a merchant experiences a high volume of friendly fraud chargebacks, this adds towards the total number of chargebacks for the business. High chargeback ratios can result in costly penalties for merchants on behalf of issuing banks, and puts them in the risk of getting their account terminated.

Just to give you a reference, a good chargeback rate is considered to be below 0.65% for most issuers - anything higher than 0.9% could lead to costly penalties from card networks.

6. How can merchants fight friendly fraud?

Friendly fraud might be difficult to prevent before it happens, but there are some good practices that merchants can apply to protect themselves to the highest extend possible. So, let's take a look at some of the best ways to deal with friendly fraud chargebacks before and after they happen.

6.1. Collect all documentation

Because chargebacks are filed directly with the issuing bank, it will be up to the merchant to prove that the original transaction was legitimate.

For example, if the customer disputed the transaction saying that they never purchased the item, the merchant can fight back by making sure that they provide all the documentation and written proof to show that it actually happened.

This can include receipts, signatures taken upon delivery, chats, call transcriptions and more.

6.2. Look up their account and purchase history

In order to dispute a friendly fraud chargeback effectively, it helps to show that the customer actually set up an account that was verified by the merchant.

You can use fraud and other tools, as well as an advanced Payment Gateway to screen activity and check if the cardholder has a consistent transaction history using the same address, email address and phone number. This will show the issuing bank that the customer completed other purchases in the past, and never filed a chargeback.

6.3. Provide excellent customer service

As we mentioned previously, friendly fraud chargebacks are not always done with fraudulent or malicious purposes. Sometimes, they can be filed from ignorance, confusion or because the customer felt that they weren't able to solve their issue directly with the merchant.

To reduce non-malicious friendly fraud chargebacks, you need to ensure that you are offering the best customer service possible for your customers. Providing multiple forms of communication such as chat, phone support, email support, social media messaging, etc will help them speak with you quickly and easily and reduce frustration.

6.4. Set realistic expectations

While this may not help much if the friendly fraud chargeback has malicious or fraudulent intentions in the first place, it can help to prevent chargebacks that were filed out of disappointment and frustration.

As a merchant, it will be important to set realistic expectations for your products or services. A customer who feels misled or lied to may feel like it's pointless to speak directly with you to resolve their issue, and may opt to handle it directly with the bank instead.

6.5. Blacklist customers with a history of chargebacks

According to Chargebacks911, about 40% of customers who commit friendly fraud will do it again in the next 60 days. The problem is, when cardholders are successful with a chargeback, they often get to keep both their product and their money - which incentivizes them to try again, and especially with the same merchant.

For this reason, it's important to monitor this type of activity and blacklist customers who often file chargebacks. It is estimated that customers who file a payment dispute will take advantage of the merchant at least 2 or 3 more times before he notices or starts taking any preventive measures.

By blacklisting fraudsters who are trying to take advantage of you, you will prevent further friendly fraud chargebacks from the same customer. Remember - high chargeback ratios can result in costly penalties for you by the credit card issuer!

6.6. Keep customers updated

As a merchant, another thing you can do to prevent a friendly fraud is to fulfil orders on time and track return shipments. While shipping delays are not uncommon, they may trick customers into thinking that their order is never going to arrive, especially around busy holidays such as Christmas.

By keeping customers updated about each stage of the shipment, you will help them feel more relaxed about their order. Make sure to track both coming and going packages, and issue refunds immediately upon receipt of a return.

6.7. Don't be afraid to issue refunds

Many businesses try to avoid issuing refunds as much as possible because they are afraid of losing revenue. However, not offering refunds when they are actually needed may significantly increase your chargeback ratio, and lead to serious consequences such as the termination of your account.

It's better to issue a refund than getting to a chargeback dispute, in which you will lose both time and money.

6.8. Use fraud monitoring tools

There are many security tools and practices that you can implement to reduce the number of chargebacks, or prevent them before they happen. One of the best ways to take advantage of many of them at the same time is by using a Payment Gateway that provides all the features you need.

For example, MYMOID helps you address fraud, reduce chargeback volume, monitor leaks 24/7, and store payment data safely due to our PCI-DSS Level 1 compliance.

6.9. Make sure your descriptors are easy to identify

As we mentioned previously, it's easy to get confused if your descriptors or corporate identity don't match the ones that the customers know of you. So, make sure that it's very clear who is sending the receipt, and what exactly it is about. This way, you will save yourself the frustration of accidental chargebacks.

Conclusion

While friendly fraud chargebacks are often difficult to identify, prevent or even fight, it doesn't mean it's impossible. You just need a good ally on your business growth journey to help you process payments, fight fraud, and maximize your revenue as much as possible. Contact us for more information!

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

Transacciones denegadas: 4 recomendaciones que te ayudarán a reducirlas

Conoce las prácticas que los comercios pueden implementar para trabajar sobre las transacciones rechazadas y reducir así el uso de la red y las denegaciones por sospechas de fraude, mientras recuperan sus ingresos de forma segura.

2018-04-11

Cómo la normativa PCI-DSS afectará la industria de viajes en 2018

La industria de viajes tendrá que dirigirse hacia una solución más sostenible y segura.

2018-01-04

¿Qué es una pasarela de pagos y cómo funciona?

¿Qué es exactamente la pasarela de pagos y cómo funciona? En este artículo, te explicamos la ciencia detrás de este servicio digital

2017-11-07

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy