5 Benefits of Payment Tokenization for Businesses (2022)

we will talk about tokenization as a smart and effective way to protect cardholders’ data, and we will cover some of the biggest benefits of payment tokenization for both businesses and consumers.

With the unprecedented rise of technology in the Information Age and the exponential increase in digital payments (which are expected to hit $10.5trn by 2025), one thing that has also increased in parallel is the number of cyberattacks and data breaches.

According to Intuit, online payment fraud made up a total of 459,297 reported instances of fraud and identity theft combined over the last year.

For this reason, data security has become one of the biggest concerns and priorities among millions of organizations globally. In this article, we will talk about tokenization as a smart and effective way to protect cardholders’ data, and we will cover some of the biggest benefits of payment tokenization for both businesses and consumers.

What is payment tokenization?

Payment tokenization is the process of converting sensitive data, such as credit card numbers, into randomly-generated, undecipherable values called tokens. These tokens are created algorithmically, and they help to prevent credit card fraud by hiding sensitive information behind random elements with no extrinsic value.

In other words, every time companies want to store the credit card numbers of their clients into their database, the tokenization system will transform this data into tokens that have no exploitable meaning.

These tokens serve as a reference within the tokenization system in a way that it’s mapped back to the sensitive data when needed, for example when a customer wants to store their credit card for faster purchases in the future.

However, the mapping back to the original data is not possible without the reference of the tokenization system, meaning that cybercriminals that steal these tokens can’t decipher their value or exploit their meaning, which is what makes this method so good against fraud.

Of course, it’s important to keep in mind that all tokenization systems should be secured and validated using best practises applicable to audit, storage, data protection, authentication and authorization, such as the ones covered in the PCI-DSS standard.

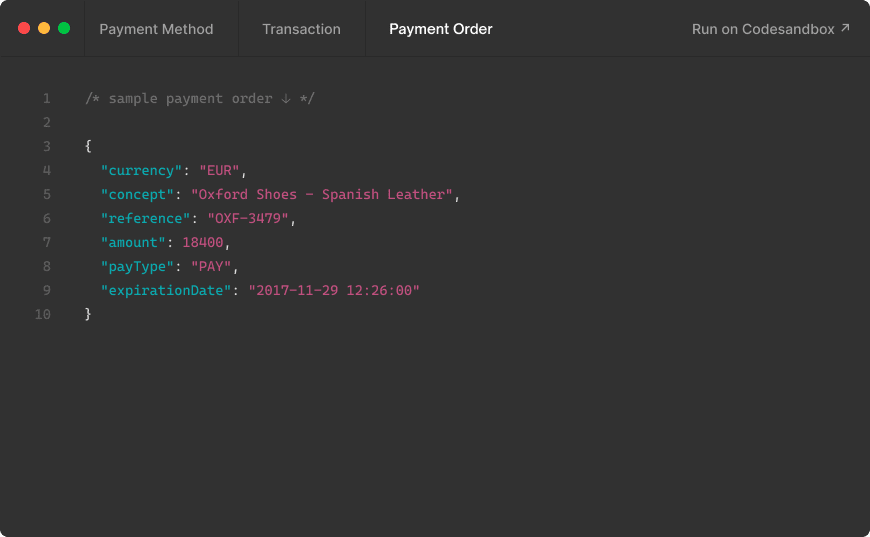

How does payment tokenization work?

In a traditional, non-tokenized transaction, the credit card number is sent to the payment processor, and then stored in the merchant's POS terminal or other internal systems for later reuse. Now let's see what happens during a tokenized transaction.

In this case, after the customer has entered his credit card number, instead of going directly through the payment processor, the data is first sent to a tokenization system.

This system assigns a random combination of characters to the credit card number, or the so-called token. After the token has been generated, it is returned to the POS terminal and the payment processor in a safe form in order to complete the transaction successfully.

The process of payment tokenization. Image source: medium.com

What are the differences between payment tokenization and encryption?

Before we talk about the benefits of payment tokenization, there are a couple more questions that we need to clear out. One of them is the differences between tokenization and encryption, which is something that many people often confuse.

Encryption is a way of rearranging or altering data in a way that appears random. It requires the use of a cryptographic key, or a set of mathematical values that both the sender and the recipient agree on.

Source: Cloudfare.com. Benefits of encryption vs benefits of payment tokenization.

While encrypted data typically appears random, the process of encryption works in a logical and predictable way, which allows the receiver of the encrypted data to decrypt it back to its original value. To be fully secure, encryption should use keys that are complex enough to be difficult to decipher by guessing, for example.

As opposed to encryption, a security method that allows information to be deciphered with the adequate key, tokens cannot be decrypted outside the tokenization system as there is no mathematical relationship with the original account number.

Because the token usually contains only the last four digits of the actual credit card for a specific transaction, hackers will not be able to access the whole account number of the cardholder.

5 benefits of Payment Tokenization for businesses

Payment tokenization is not only a great method to reduce online payment fraud and protect cardholders’ data from cyberattacks, but it also has a lot of advantages for businesses. Here are some of the biggest benefits of payment tokenization:

1. Helps to build trust with customers

As we already mentioned, one of the most important benefits of payment tokenization is security**,** which helps companies to establish trust with their customers.

Although online payments are constantly growing, especially after the global pandemic kept millions of people at home shopping online, many people still don’t feel safe making online payments.

Building trust and loyalty with their customers is essential for the healthy growth of every business, and assuring that their payment data is secured is one way to do that. In fact, according to multiple studies:

• 65% of data breach victims lost their trust in a company after a breach;

• 80% of consumers will avoid purchasing from an organisation if their data has been compromised in a security breach;

• 85% of victims of a data breach will share their negative experience with others, causing an even further impact on the reputation of the compromised company;

• 52% of customers would consider moving to a competitor if they provide better security.

Tokenization ensures the correct formatting and transmission of data, making it significantly less vulnerable to cyberattacks and payment fraud. This helps to keep online transactions secure for both customers and businesses, fostering trust and good reputation in the long run.

2. Prevents costly penalties and revenue loss

Second on our list of benefits of payment tokenization is the prevention of revenue loss and costly penalties imposed by different institutions.

The previous statistics that we mentioned showed that compromised security has a negative impact on the reputation of a business that’s been involved in a data breach. This often translates to direct revenue loss for companies as customers move to competitors who are taking better care of their payment data.

Unfortunately, this isn’t the only way in which companies may suffer losses after a data breach. They can also get involved in expensive lawsuits, especially if the breach has compromised the sensitive information of thousands or millions of people.

One famous example is the video-conferencing platform Zoom, a company that spiked 376% in revenue after the global pandemic moved all meetings online.

Image source: techrepublic.com. Zoom’s security issues & the benefits of payment tokenization

However, after a series of cybersecurity breaches, including a misleading end-to-end encryption that turned out not to be true, the company had to set up an $85 million fund to pay cash claims to U.S. users.

This amounted to anywhere from $15 for non-paying users to $25 for those with paid subscriptions. On top of the fund, Zoom also had to pay about $21 million in legal fees, according to the ruling.

On top of lawsuits and direct revenue loss, companies that suffer data breaches or don’t comply with the PCI-DSS standard for payment security are also facing possible penalties by financial entities. In fact, non-compliance with PCI can result in monthly fines ranging from $5,000 to $100,000, imposed by credit card companies.

If a company has suffered a breach in which credit card information has been endangered, they can expect different penalties, including fines of $50-$90 per cardholder whose data has been compromised, or even termination of the relationship with the bank or payment processor.

3. Improved internal security

Another one on our list of benefits of payment tokenization is improved internal security.

Because the token is practically unreadable by anyone except for the payment processor, companies ensure both external and internal protection, including employees or other people connected to their business.

4. Allows for recurring payments

One of the biggest benefits of payment tokenization for businesses is that it allows them to accept recurring payments and other payment options in a safe environment, simplifying the subscription-based processes.

In fact, tokenization is a game-changer when it comes to secure recurring payments. On one hand, subscription-based services are on the rise - according to SAP Insights, 53% of all software revenue will come from subscription models in 2022.

On another hand, more and more people are embracing online shopping for everyday items, and they have a growing preference of storing their payment details in order to make these purchases faster and more convenient.

Tokens are a great way to achieve this convenience and simplify the buying process. Because they convert sensitive information into random values that are undecipherable outside the tokenization system, it allows companies to store credit card data in a way that doesn’t compromise its security.

Benefits of payment tokenization

5\. It makes compliance with PCI-DSS easier

Undoubtedly, one of the most important benefits of payment tokenization is PCI-DSS. With the rise of digital payments adoption and the concerns regarding potential fraud and cyberattacks, it is no wonder why data security has received so much attention during the last couple of decades.

For this reason, the biggest credit card companies gathered in 2006 to establish strict and efficient security standards that regulate the management of credit card data, or the so-called PCI-DSS - Payment Card Industry Data Security Standard.

If older POS and other database systems allowed the storage of credit card numbers and their free exchange over networks, the arrival of PCI made it no longer possible.

Nowadays, PCI Compliant businesses must store credit card data precisely through the tokenization method, making transactions and sensitive information safer and less vulnerable to hackers.

It is important to note that tokenization applies not only only to credit card numbers, but also to any kind of personally identifiable information, such as passwords, files and customer accounts.

Other PCI-DSS requirements to maintain payment security include, but are not limited to:

• Building and maintaining a secure network

• Maintaining a Vulnerability Management program

• Restricting physical access to cardholder data

• Assigning a unique ID to each person with computer access

• Regular monitoring of all accesses to network resources

• Maintaining an Information Security Policy

Benefits of payment tokenization: PCI-DSS

How can you become PCI-DSS compliant and tokenize your data?

Keeping data safe is not only one of the benefits of payment tokenization, but the concept of tokenization is one of the main pillars of the PCI-DSS (Payment Card Industry Data Security Standard). To become PCI-compliant, you can either obtain a certification for your organisation, or hire a third-party provider.

However, getting certified in PCI can be extremely costly for many companies. To give you an idea, a Level 4 can cost up to $90,000 with an annual maintenance of $35,000, while Level 1 may even reach 1,000,000 with an annual maintenance of $250,000.

For this reason, using the services of an already compliant digital payments provider is the widely preferred alternative for many businesses, especially considering all the added features and benefits that it may offer.

For example, on top of PCI-DSS compliance, MYMOID offers:

• Multi-acquisition for full independence thanks to our strategic alliances;

• Universal Tokenization to make your tokens independent of other processors;

• Advanced Dashboard to manage all of your payment orders with advanced filters;

• Collection Suite for improving conversion ratios and debt recovery operations;

• Multiple payment options such as recurring payments, instant payments, IVR payments and Pay by Link.

Additionally, we offer tools and features to help you reduce chargebacks, pre-authorize your payments, or simply sell online in more than 45 countries and in 130 currencies.

If you are looking for a fully compliant third-party provider, MYMOID is a payment platform that allows you to process and store cardholder data in a completely safe environment. You can contact us for more information.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

Acquiring bank: definition and role in payment processing

What exactly is an acquiring bank, and what are its main functions in the process of managing transactions?

2021-01-10

Fraude Online: definición, tipos, y cómo proteger tu comercio

Conoce acerca del fraude y las medidas de seguridad que pueden ayudarte a proteger tu comercio de transacciones ilegales.

2018-04-26

El Banco Adquirente y su papel en el procesamiento de pagos

¿Qué es exactamente un banco adquirente?, y ¿cuál es su papel en la gestión de transacciones?

2018-05-10

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy