10 Benefits of IVR Payment Processing For Your Call Center

What are the benefits of IVR Payment Processing for your call center, and why do you need a PCI compliant IVR solution for your business?

One of the most important goals for any business today is to streamline operations and reduce overhead costs. Making business operations efficient involves several factors. In the contemporary world of evolving advancements in technology, business automation, where possible, is perhaps the most cost-efficient corporate decision.

IVR payment processing helps automate a significant portion of your call centers. Instead of the customers and clients having to wait for an agent, they can pay their due bills and make transactions with the help of an IVR payment processing system. It will cut down time for getting due payments and clearing customer financial accounts faster.

If you have been looking to grow your business but have doubts about handling an overload of financial accounts through your call centers, the IVR payment processing system can help. Keep reading for all the details.

Benefits of IVR payment processing for your call center

What is an IVR Payment Processing System?

IVR stands for Interactive voice response. It is an automated technology to help you deal with customers through telephone communication. In previous years, IVR systems were a bit different, where the customer calls were attended by technology, and they presented a menu of options.

Depending on the customer's choice, the individual would be redirected to an employee in the sales, finance, or other departments.

With the latest advancements, this is no longer necessary. The current IVR payment processing systems make it possible for your business to ease the load on call center agents by using automated interactions for customer payments and bills.

Contactless payments have become huge over the past two years, and IVR payment processing helps you accomplish just that. The customers won't have to wait for a call center agent to make payment for buying your products and services. Instead, an automated system will guide them till the end to make secure payments.

Here is how your call centers can benefit from an IVR payment processing system.

1. Collects payments without an intermediary party

IVR payment processing helps customers to make payments without needing a call center agent. Several times, especially during peak hours, when an agent is unavailable, the customer will have to wait to pay the bills. This can lead to significant frustration on the customer's part and other issues like late payments.

The IVR automated system does not require the customer to wait for an agent to complete their payment. They can buy whatever they want and bills by interacting with automated technology. The bill will be cleared without a hassle.

2. Reduces late payments from customers

With call center agents, the customer will have to wait for an agent to be free most of the time. This can cause a lot of friction in the process of sending and receiving payments. Customers will be hesitant to pay the bill as they have to wait for an agent. Other times, there might be errors in human interaction.

Some people might not be willing to wait and may cut the call. Several factors work together to delay the payments when call centers are manned by humans alone. This can increase turnover periods for accounts receivables.

IVR payment processing can cut down the turnover period by allowing interruption-free calls where the customers can immediately make the payment after the call without waiting for an agent.

3. Provides a secure method for payments

IVR payment processing system is highly secure, so your customers won’t have to worry about their data being stolen or mishandled. IVR payment systems have to be compliant with PCI and NACHA. This means that access to the data stored in the system is restricted, and there is complete data encryption.

Moreover, your customers will have to go through the steps of verification and authorization according to the data in the system before making payments. The agents are not manually handling the transaction, so the risk of error is also reduced. You must ensure that your IVR payment processing system is PCI level 1 compliance to have full security from data leaks or breaches on the system.

In our previous article, we talked about the importance of having a PCI Compliant IVR Solution for your call center. This means that your IVR is in compliance with PCI-DSS, also known as the Payment Card Industry Data Security Standard.

This is a set of protocols and regulations created and implemented by the biggest credit card issuers VISA, Mastercard, Discover, American Express and JCB. It was established in 2004, and complying with it is an obligatory requirement for all companies and merchants that process, handle, or store cardholder data.

4. Reduces overhead costs

IVR payment processing significantly reduces the overhead costs for a call center. You don’t have to keep the agents working after their shifts or give overtime due to incoming calls. The IVR system can easily handle it for you.

Workers can take breaks and work their shifts only. Several people make payments after the working hours are over, but it can be hard to keep call center agents working round the clock. This reduces overhead costs of hiring and maintaining a huge workforce to man call centers.

5. Enhances customer experience and interaction

Customer is king for any business, so it is essential to keep the customer experience top-notch and streamlined. An automated system such as IVR payment processing helps keep the payment process efficient and quick. Customers don’t have to wait for frustrating long periods or stay on hold while being transferred to the relevant agent. All these experiences reduce customer satisfaction.

Through the IVR system, the customer can call and make a payment without wasting any time. Moreover, you can send reminder messages and emails via the system to encourage customers to make payments early. This will also improve customer loyalty.

6. Frees workforce for other tasks

As IVR is set up and placed to handle payment calls, several call center agents will have more free time on their hands to deal with other complaints and issues. Several high-value clients need personalized attention.

Other times some high-profile issues require the immediate aid of an agent. Automating payments will leave the agents free for other such issues while the customers complete their payments in a hassle-free process.

7. Allows quick dealing with payment issues

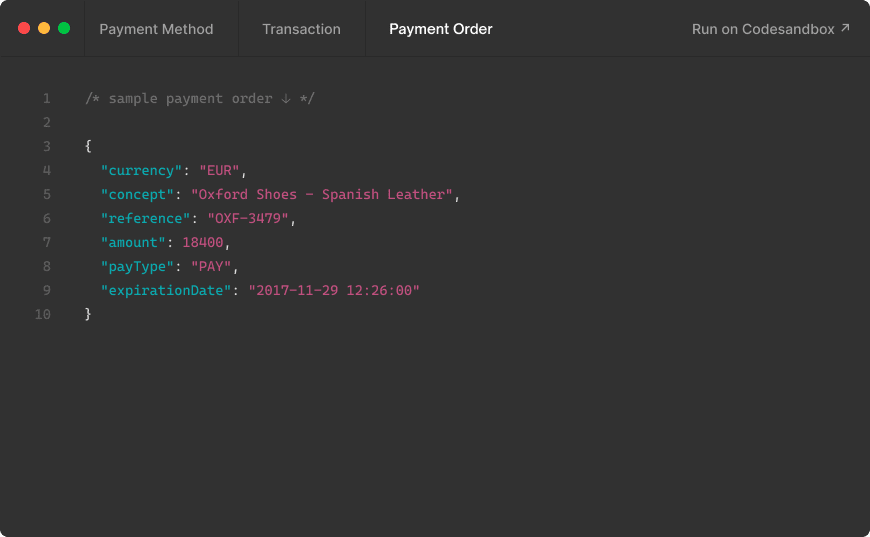

IVR payment processing is useful for more than just collecting payments in an automated process. It can help you and your agents to resolve issues pertaining to bills and payments, especially when we are talking about declined transactions which is quite a common issue for a lot of merchants.

As the customer makes payments through the IVR payment system, not just their card information but all their billing information, such as time and date, are saved in the system.

You can easily access the information about when and where the customer made the payment and through what mode of transfer. This will help you to quickly solve any complaints that come up for payments and billing.

8. Offers 24/7 Payment System availability

Today the world has become more connected and accessible than ever due to the ever-available technologies. When customers deal with a business, they expect the same from their service. They expect to be able to reach them anytime, anywhere.

An IVR payment processing system will make it possible for a call center to be on its feet 24/7. Customers can reach your system anytime and make payments at any hour. This not only helps retain the customer but also decreases the turnaround time of accounts receivables.

Moreover, the 24/7 availability of the automated answering system will ensure that customers can get answers to their redundant questions.

9. Handles more volume of calls efficiently

Certain periods during the year or some hours during the workday are busier than usual due to the high influx of customer calls. The IVR system helps reduce the burden on call center agents and clears up the waiting line by dealing with customer payments and billings.

This ensures that the business does not have to reduce the intake of customer calls or keep the clients waiting for long due to high volume or peak hours. You can take up as much call volume as you like with an IVR system.

10. Integrations with other systems

IVR payment processing system can be streamlined with other customer relationship management systems in your company to provide a complete solution. Integrating this system with other CRM software in your firm will help streamline the business and make it more efficient, as employees can access it from different call centers.

Additionally, this will keep the data about customers centralized and will help to provide a better customer experience.

How Does IVR Payment Processing Integrate With The Future?

A few years ago, IVR might have been a vague dream for most small and medium companies. However, the advancements in the modern world have made the IVR payment processing system more accessible for businesses of all sizes.

You may think of IVR as just a technological system. However, it fits in to help you in the bigger picture. The IVR payment processing is a part of the entire system of the company that helps create a valuable brand image for the customers.

As you provide a better customer experience, you will retain more customers and your brand will grow. Customer experience is directly linked to brand value, and strength.

And it is not just the customers who will benefit. You will be able to streamline the operations of your call center like never before. There will no longer be stuck-up calls and overworked agents looking to get rid of the high volume of work.

One important thing to keep in mind is that the IVR payment system is not here to remove or replace human agents. The main intention is to aid them so personalized calls can be directed toward customers who need them instead of wasting them on redundant tasks.

Automation is certainly the future, and you must incorporate it into your brand to thrive.

Conclusion

Complying with PCI-DSS and taking full advantage of a PCI-Compliant IVR Payment processing for your call center is easy if you are working with an advanced Payment Gateway that is already in compliance with the Payment Card Industry Data Security Standard.

If you are not accepting online payments with an IVR system yet, or you not in compliance with the protocols set by the biggest credit card issuers, don't worry - we've got the solution for you.

Contact us and we will tell you more about MYMOID and all the payment solutions we offer for call centers, in addition to providing a set of security layers so you can easily grow your business with us. Are you ready? Contact us today.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

What is Payment Request Link (Pay by Link)? 5 Things You Need to Know

What is Payment Request Link (pay by link), and what are some of the most important things that you need to know before using it?

2022-09-27

4 consejos para ganar una disputa por chargeback (como comercio)

Conoce las medidas que puedes tomar para aumentar tus posibilidades de ganar una disputa por chargeback.

2018-08-16

La importancia y los beneficios de la tokenización en los pagos digitales

Conoce cómo utilizar la tokenización para gestionar este proceso de forma segura

2017-12-14

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy