5 things to consider when choosing a Virtual Terminal for your business

Choosing the right Virtual Terminal for your business is one of the most important steps in getting started with your digital journey. For this reason, before proceeding with your evaluation of acquisition service providers, we recommend you to take these 5 things in mind.

Along with the Payment Gateway, it is responsible for the credit card processing of all transactions that happen online.

However, taking this decision is not always as simple as it seems. For this reason, before choosing a Virtual Terminal and hiring the services of its corresponding provider for a long time, it is extremely important to make sure that you have a good understanding of your very own needs.

For this reason, before proceeding with your evaluation of acquisition service providers, we recommend you to take these 5 things in mind:

1. Multi-acquisition

One of the most important, but surprisingly underrated factors for businesses considering a Virtual Terminal is the multi-acquisition factor. Let me explain.

When you start processing transactions online, you will discover that the rapid development of technology, among with the constant changes in customer expectations, are re-shaping the payment landscape with the speed of light. As a digital company, you will also change a lot along the way.

With these considerations in mind, your needs will also face an important change. You will probably launch new services that demand specific technology, and your current credit card processor might not be able to provide.

What happens if you need to enable recurring payments or cover local payment methods, and your processor doesn't have the technology to meet your needs? Many companies even use more than one Virtual Terminal depending on their specific needs for a service.

Of course, you could go through all the hard work of changing your processing provider, but there is one problem: tokenization. When you use an acquirer for converting your customer data into secure tokens, the moment you want to change your provider, these tokens will no longer be compatible with the new one - and you will have to generate them all once again, worsening customer experience along the way. So how can you resolve this problem?

MYMOID's solution is multi-acquisition. Because we are capable of integrating our payment gateway services with various credit card processors, we provide our customers with universal tokens that are completely compatible with all acquirers - so you don't have to generate new ones all over again if you decide to change a provider.

Check out our latest ebook: The Anatomy of a Payment Gateway

2. Consider monthly fees

Cutting on unnecessary costs is extremely important for every business, especially when we are talking about small and middle-sized ones. When researching for a Virtual Terminal, pay close attention not only to the processing fees charged by acquirers per transaction, but also to initial and monthly fees.

In addition to transaction fees, some companies also charge their clients for the initial setup of the virtual POS, and on top of that, a fixed monthly fee that quickly adds up to more costs for the merchant. Sometimes, a monthly fee allows acquirers to reduce the cost for transaction fees, but it is not always the case.

Other costs that many companies often forget to consider during the evaluation of acquisition service providers is the management costs for fraud, disputes, chargebacks, guarantee funds, and even retentions. This type of costs is usually not seen as important because it’s occasional and doesn’t form part of the main activities of the company; however, it can raise expenditure significantly in case that any issues happen to occur.

Another factor that can often be underestimated is the delay in settlement. Liquidations above T+3 and T+5 can have a negative impact on the cash-flow of the company, often compromising its long-term economic viability. For this reason, at MYMOID we only work with acquirers that are able to provide a next-day settlement (T+1).

Having said this, try to look for acquirers that do not charge setup fees nor monthly fees, unless it really is justified.

3. Security and PCI-DSS Compliant Virtual Terminal

Security is among the top concerns for every business owner and fortunately, credit card processors are working hard to ensure that customer data is protected at all times.

If you’re planning to sell online, make sure that your payment processor has partnered with a Payment Gateway that complies with the highest security levels of PCI-DSS (Payment Card Industry Data Security Standard). Traditional acquirers cannot get certified in PCI, the official standard that provides the most important layers of protection for digital payments.

You might not have this factor in mind at first, unless you hire an additional service that could result even more complex and expensive (some PSP offer acquisition services and technological solutions based on PCI) for your company. However, make sure to look for a solution that allows you to take control over your payment logic, and allows you to understand your customer behavior better.

If one of your biggest efforts is centered in the acquisition of users, why not undertake the additional efforts to retain them? At MYMOID, we understand them very well, that’s why we are Level 1 of PCI-DSS (the highest level), we offer universal tokens, and we are multi-acquirers.

Additionally, you might also want to check that your selected processor also supports SSL certificates and CVV2 verification.

Bonus: Look for a provider that has experience within your industry and business type, as this will bring you additional value and expertise. For example, MYMOID has obtained a solid know-how in the microfinance sector over the years, which helped us develop powerful techniques for improving low approval ratio and debt recovery effectiveness.

4. Customer support

A surprising number of companies don't consider customer support a decisive factor when selecting a Virtual Terminal - until they encounter an issue and there is no one to talk to. Because acquirers have the majority of their processes highly automated, a lot of times it can be really frustrating to reach out to a customer support representative...or there just isn't one.

Technical issues will probably happen to you at some point of your payment processing, so it's better to be prepared accordingly. Sometimes, it's better to rely on a payment gateway for that - at MYMOID, we provide comprehensive customer support 24/7, and we are dedicated to resolving urgent matters in less than 5 hours.

5. Focus on technology

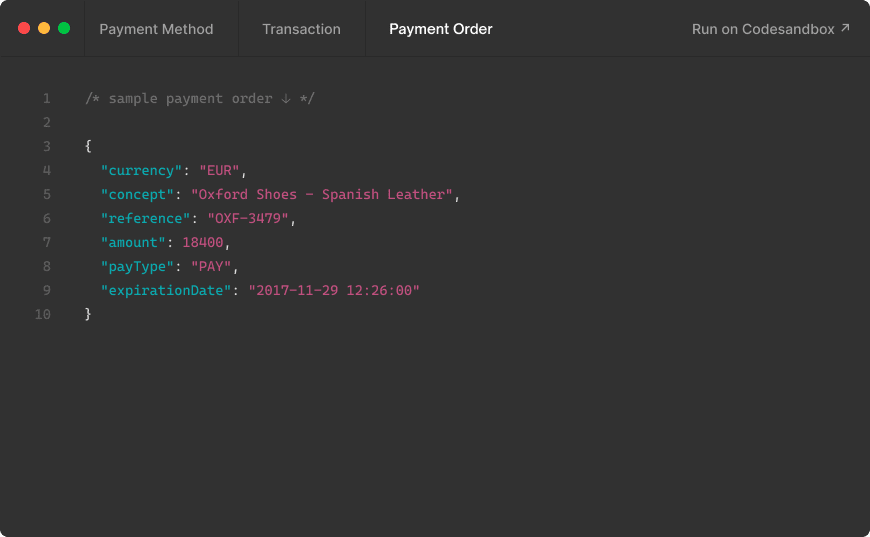

A Virtual Terminal should be responsive and needs to be powerful enough to adapt to the dynamic needs of each company. Look for a virtual POS that offers the technology and features that will bring value to your business: it could be recurring billing, online invoicing, easy API integration, or any other functionality that will give you more than just payment processing.

A lot of payment processors do not have a strong focus on technology, and more often than not is the payment gateway that covers this part. For this reason, it is important to consider a gateway that not only connects you with the acquirer that best fits your needs, but also focuses on technology to deliver better payment experience and powerful functionalities.

It is difficult to find a solution that adapts 100% to your needs. For this reason, it is important to have a Payment Gateway that allows flexibility and the easy incorporation of new functionalities via a powerful API. At MYMOID, we focus our payment technology in a way that can easily adapt to your needs, giving you full control without imposing you our vision.

For example, our versatile API integration makes the incorporation of new features fast, easy, and in alignment with our mission for innovation.

Choosing a Virtual Terminal: Conclusions

Choosing the right virtual Point-of-Sale will be one of the most important steps that you will take when setting up your digital business. For this reason, it is extremely important to take your time and do a profound research to help you decide what is it that you are looking for, and which Terminal will fit your needs the best.

And if you are worried that you might not get it right the first time, we've got you covered! MYMOID is a multi-acquisition payment gateway that connects seamlessly with different acquirers while keeping you independent with our universal tokens. For more information, do not hesitate to contact one of our representatives today.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

Card Testing Fraud: 7 Important Things To Know in 2022

What is card testing fraud, what makes it so dangerous for merchants, and what are the most effective steps they can take to protect themselves? Continue reading to learn more

2022-07-16

3 Common Types of Chargebacks & How to Deal With Them

What are the most common types of chargebacks, and what can merchants do in order to handle them safely? Continue reading to learn more!

2022-04-02

¿Qué es el banco emisor? Definición y funciones principales

Procesos que suceden desde la perspectiva del consumidor y la institución que lo representa y responde por su capacidad para realizar pagos digitales: el banco emisor.

2018-05-17

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy