What is an Issuing Bank? Definition and role in the payment network

take a look at what happens from the perspective of the customer and the financial institution that represents and responds for his capacity to pay off debts: the Issuing bank.

In one of our previous articles, we explained the role of the Acquiring bank or entity as a financial institution that processes credit and debit card payments on behalf of the merchant. In this article, we will take a look at what happens from the perspective of the customer and the financial institution that represents and responds for his capacity to pay off debts: the Issuing bank.

What is an Issuing Bank?

The Issuing bank is an institution that issues credit and debit cards to customers on behalf of the card networks (such as Visa, Mastercard, Discover, American Express and JCB, among others). This bank, also known as the Issuer, acts as an intermediary between the customer and the card network by verifying that the cardholder has sufficient funds for completing the transaction.

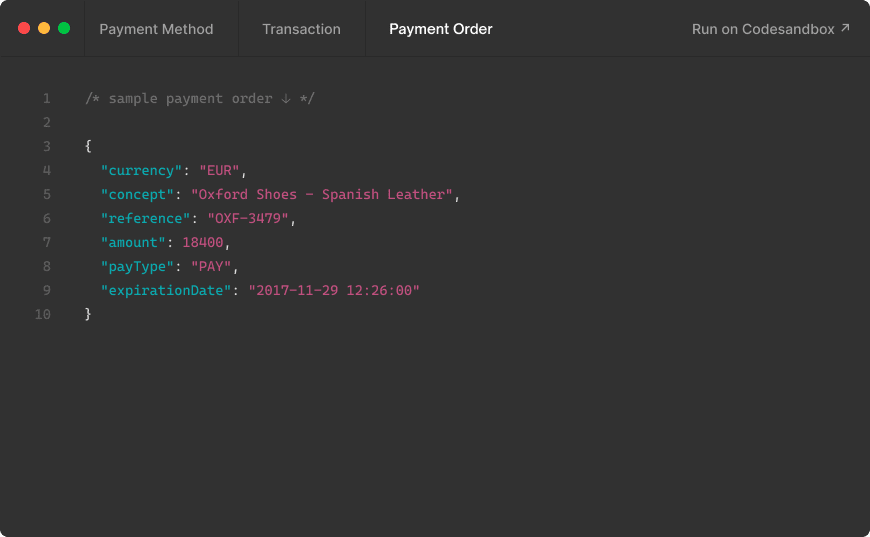

The Issuing bank assumes the responsibility for providing financial back-up for transactions made with the corresponding card. When the customer initiates a payment with his credit or debit card, the acquirer sends the data to the card network to the determine whether the transaction will be accepted or rejected.

Usually, if the customer has sufficient funds to cover the cost of the purchase and he hasn't exceeded his daily or monthly limit, the Issuing bank will approve the transaction and send its approval to the Acquiring bank, thus completing the payment.

Responsibilities of the Issuing Bank

One of the biggest responsibilities of the Issuer is to assume the liability to pay the debts incurred by cardholders. If the customer doesn't have sufficient funds to complete the payment, the Issuing bank and the Acquiring bank usually share the credit liability in accordance with the card network rules.

For this reason, card Issuers usually collect a fee for every card transaction not only to cover the costs associated with their part of the process, but also as a protection measure for possible risks.

Identification

Merchants can easily identify the Issuing bank of a credit card by looking at the card itself; the logo is usually displayed on the front side. On the back side of the card, you can find additional information concerning the location of the bank and how it can be contacted.

Sometimes, merchants might be inclined to contact an Issuer for a further payment verification or as a result from fraud suspicions.

Looking for a Payment Gateway?

If you are looking for a digital Payment Gateway for your business, MYMOID offers an innovative and fully functional set of payment solutions in compliance with the security standards PCI-DSS. For more information, get in touch with one of our professionals today.

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

Top 10 Reasons for Declined Credit Cards & How to Handle Them

A high volume of declined transactions on credit cards can lead to a series of negative consequences for merchants.

2022-02-01

Cómo aumentar el ratio de conversión de tu ecommerce: 7 consejos

Las pasarelas de pago son un componente clave en la infraestructura de los pagos digitales para aumentar el ratio de conversión en checkout, y proporcionar una experiencia de pago que reducirá el abandono de los carritos de la compra.

2018-03-15

PCI Compliance for Call Centers: 7 Things You Need to Know

What are some of the most important things to keep in mind when it comes to PCI compliance for call centers?

2018-02-22

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy