12 Awesome Benefits of Online Payments for Businesses (2022)

What are the biggest benefits of online payments for businesses in 2022?

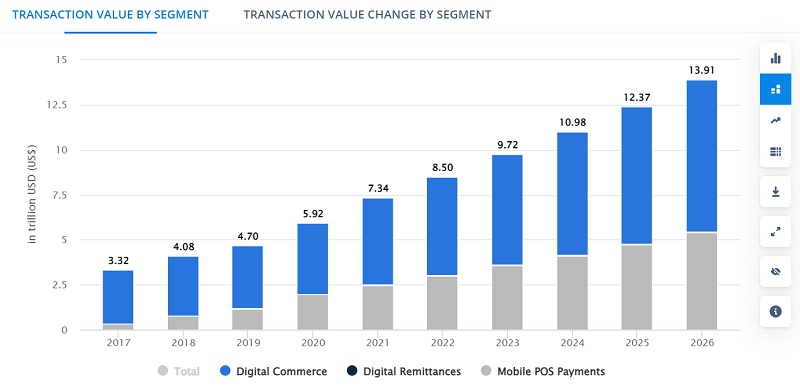

Digital payments have been on the rise for years - according to Statista, their total transaction value is projected to reach US$8.50tn by the end of 2022, and US$13.91tn by the end of 2026, with a Compound Annual Growth Rate (CAGR) of 13.10%.

Transaction Value of Digital Payments. Source: statista.com. The benefits of online payments for businesses.

However, the ever-growing adoption of technology worldwide, as well as the consumption of the Internet (which is currently being used by 66% of the entire world's population, aren't the only factors that accelerated the growth of the digital economy over the last couple of years.

The global COVID-19 pandemic was probably the biggest catalyst for the adoption of online payments. According to EY, digital retail transactions increased dramatically in the 1st year of the pandemic, with the number of customers registering for mobile banking rising 200%. Mobile banking traffic jumped 85%.

In the B2B space, the same study conducted by EY reported that about 60% of all participants cited adoption of online payments as the most meaningful change that happened over the course of the pandemic.

Considering that more than 85,000 B2B and B2C launched online shops following the global pandemic, there is no doubt that digital payments will continue to be on the rise in the next few years.

If your business isn't online yet, and you are not sure whether it should be, here are our top 12 benefits of online payments - and why your business, no matter how big or small, should be looking into the digital future.

1. Provide convenience for customers

One of the biggest benefits of online payments for customers is convenience. When purchasing online, they can select from thousands of products and services, compare and contrast easily, read reviews, make the payment seamlessly, and get the product delivered within days (or sometimes, hours).

In fact, payment technology has evolved so much that customers are now able to make payments online even if they don't have a credit card or a physical wallet on hand. From mobile wallets to convenient forms of alternative funding - such as PayPal, it's just as easy as logging into your account and completing the payment.

Other factors, such as ability to shop 24/7 - as opposed to a physical shop that closes at the end of the day - and ability to compare prices between shops and products easily is what adds even more convenience for customers.

Reasons consumers shop online & the benefits of online payments. Source: SmartInsights.com

2. Offer advanced features

One of the biggest benefits of online payments for both businesses and customers is that they provide additional features that cash or card-present transactions don't.

For example, the possibility of storing payment data through a security method called tokenization, which gives customers the opportunity to purchase again from the same merchant without having to fill out their credit card details every time.

Advanced digital payment gateways, such as MYMOID, also make it easy for merchants to accept recurring payments, allowing customers to subscribe to products and services and get charged automatically at regular intervals, such as weekly, monthly and annually.

3. Acquire more customers

Among the biggest benefits of online payments for businesses is the possibility to acquire more customers, and reach a bigger audience of potential clients. Because digital payments remove the geographical boundaries that physical stores have, merchants can sell anywhere, at any time, even reaching countries that they wouldn't be able to otherwise.

For this reason, it's important to implement an international payment gateway that has the ability to grow with your business, and give customers the convenience to pay in their own currency.

For example, MYMOID allows you to process payments across 45 countries and 128 currencies, providing a better payment experience for customers and reducing the need for merchants to hire local services for each country.

4. Reduce operational costs

When it comes to the benefits of online payments, it's also important to mention that they allow merchants to cut administrative and operational costs in a variety of ways, including:

Less paper

Using an online payment system means that companies can reduce paper-based processes by fully digitizing them. For example, billing - receipts are generally delivered via email and SMS, and they can easily be forwarded to the company's accounting department at the same time.

For merchants, this means cutting costs on materials such as paper, stamps, printing and storage.

Less labour costs

Automating payment processing not only makes payments more efficient, but it can also mean additional savings for businesses when it comes to labour costs as there will be less work in the handling of payments. So, fewer human resources will be needed.

More data

Among the biggest benefits of online payments is that they allow for the collection and analysis of customer data. As a result, companies are able to detect their strengths and weaknesses and become more efficient at every step of their processes.

Source: invoicecloud.net

5. Adapt to user behavior

As the digital economy is growing, customers have more and more options to research and buy - as a result, customer behaviour is becoming more complex. According to Oberlo, 63% of all shopping occasions begin online, no matter if the actual purchase ends up being online or in the brick-and-mortar store.

This means that, even if the customer doesn't complete the purchase on your online store, his shopping intention may start there. With these statistics in mind, it's easy to see how businesses that don't have an online presence could be missing out on a lot of sales.

However, the complexity of consumer behavior doesn't stop there. While many customers begin their research online, there are also customers who research and decide on a product from the physical store, but then go and buy it online.

This happens a lot with the purchase of clothing and shoes. People try them in the store to ensure that they fit them, but go and buy them online for the convenience of it, or due to the fact that online stores typically have more color and model options to select from.

In other words, user behaviour is not as straightforward as it used to be just a decade ago. For this reason, companies that don't have an online store are missing out on one of the biggest benefits of online payments to drive more sales for their business.

6. Optimize and predict cash flow

Among the most important benefits of online payments for merchants is the optimization of cash flow. The digitization of your business means that you will be able to charge automatically for subscription-based services, send payment reminders, communicate with customers, and offer flexible payment alternatives if the transaction has been declined.

All of this will help you optimize your cash flow and have a higher predictability of your payments.

Additionally, since many people prefer to pay online because it's more convenient and saves time, they will be less likely to delay the payment of their bills. They can do it from anywhere, at any time, without having to go to a physical location and waste time waiting on the queue.

As a result, you will have to send less reminders, which will give you the ability to collect revenue faster.

7. Make data-driven decisions

As we touched previously in one of our points, among the biggest benefits of online payments is that they give merchants the golden opportunity to track and analyze consumer behaviour, and make data-driven decisions based on it.

Companies can learn more about their customers by looking at behaviour such as:

• The products and services that they view on the merchant's website;

• What device they are using to purchase;

• What are their preferred payment methods;

• How much time they spend on the website;

In addition, businesses can offer personalized experiences based on data from search, viewed, and purchase history. Demographic data, such as gender, age or the location from where they are purchasing, can also help determine customer needs or problems they need help solving.

In other words, collecting customer data helps businesses:

• Personalize shopping, as well as payment experience;

• Predict customer acts and events before they happen;

• Deliver a better customer experience;

• Implement dynamic product pricing;

Collecting all this data not only helps merchants boost the sales in their online store, but these insights can be applied to physical stores as well.

Benefits of online payments. Source: drip.com

8. Secure your transactions

Even with cybersecurity risks, online payments offer a lot of security for transactions. All merchants that handle, process and accept digital payments should comply with the Payment Card Industry Data Security Standard, also known as PCI-DSS.

It's a set of safety measures created by the world's biggest card issuers with the purpose of ensuring the secure processing and handling of digital payments. It includes the implementation of methods such as encryption and tokenization, which convert sensitive information into code for its secure and reliable transmission online.

Other security methods include two-factor authentication, SSL encryption, 3D secure, PSD2 and more. The fastest way to ensure full security when processing online transactions is by implementing a Payment Gateway that already complies with all these measures.

9. Enjoy a fast and easy setup

Among the biggest benefits of online payments is that they are incredibly easy to set up. Many small businesses are afraid of going online thinking that it's a slow and long process - but this couldn't be further from reality with the right payment gateway.

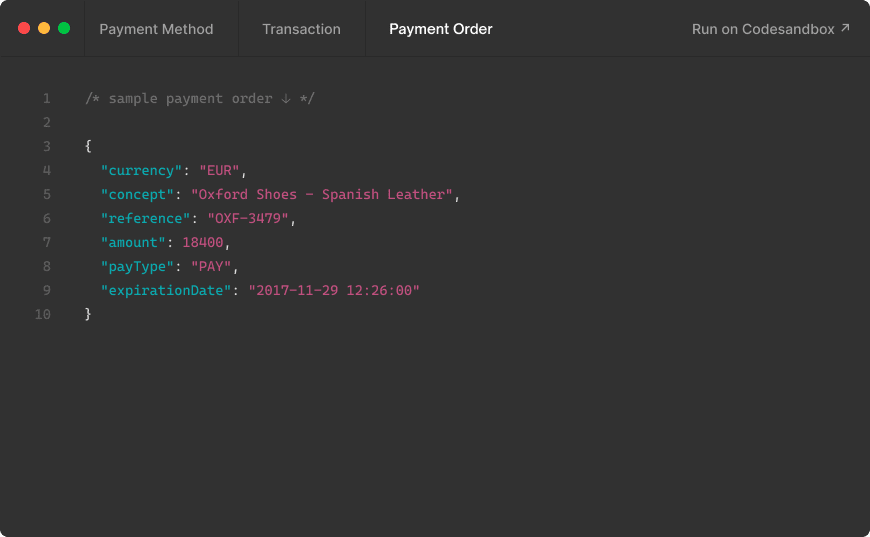

For example, you can implement MYMOID quickly and easily with our powerful API-Rest, and start accepting payments online without the need to handle the heavy lifting. We will do it for you!

10. Offer flexible payment options

Among the most important benefits of online payments is the possibility to implement flexible payment options, something that's challenging to do in a physical shop. Being able to pay with their preferred method is among the top priorities of customers when shopping.

Preferred payment methods of online shoppers worldwide. Source: statista.com

From credit and debit cards to digital wallets (such as Amazon Pay, Google Pay, and Amazon Pay), or even methods such as PayPal, Stripe and Square, customers prefer to have as many options as possible in case the payment can't go through.

Over the last few years we are seeing more and more payment options - such as Klarna, a financial solution that lets people pay for products and services in 4 equal installments.

11. Build authority and credibility

Among the most underestimated benefits of online payments is the opportunity to build authority and establish trustworthiness.

Considering that more than 60% of customers start their shopping and search online, a business that doesn't have a digital presence is not only more difficult to find and access by customers, but also misses out on the opportunity to establish authority and generate more brand visibility.

Being online also means that you provide faster and more convenient channels for communication. If customers are able to reach you quickly and easily online in case they have any doubts about your products or services (or want a refund), they will be more inclined to trust your brand and continue buying from you.

12. Boost sales

There is a variety of ways in which accepting online payments can help you boost sales.

From collecting data to offer personalized discounts and experiences to your customers to being able to offer more products and services to a wider audience, you open your business to opportunities that you don't have with regular stores.

Another way in which companies can boost their sales is by take advantage of mobile shopping, which has been on the rise in the last few years. According to Oberlo, almost 50% of consumers shop more on mobile as opposed to physical stores.

They are using their mobile devices for all steps of the buyer journey, which gives businesses a great opportunity to increase their sales and reach more customers. Even if they don't end up making the final purchase through their mobile device, it is still a main part of their shopping journey, and help them make the final decision on where (and what) to buy.

Leveraging the benefits of online payments

There are multiple benefits of online payments that companies can leverage if they go online. Luckily, digitizing your business isn't hard at all - all you need is a fast, reliable and secure payment gateway with all the advanced features that you'll need to maximize your sales.

If you are ready to go online, look no further - MYMOID is the perfect solution for your business. Contact us and get started today!

From the blog

Stay updated with the latest news, tricks and tips for MYMOID

What can a MYMOID Payment Gateway Do for Your Business?

MYMOID Payment Gateway: making digital payments easier for everyone

2018-02-27

10 Effective Ways to Reduce Subscription Churn Rate

What are some of the most effective ways to reduce subscription churn rate? Continue reading to discover how merchants can handle this common challenge.

2022-07-24

El Banco Adquirente y su papel en el procesamiento de pagos

¿Qué es exactamente un banco adquirente?, y ¿cuál es su papel en la gestión de transacciones?

2018-05-10

Ready to start?

Pioonering digital payments since 2012. Trusted by +5.000 companies, startups and retail stores.

© 2024 MYMOID. All rights reserved.Legal noticePrivacy policyCookie policy